Comprehensive Debt Consolidation Loan: Expert Guidance and Solutions

Comprehensive Debt Consolidation Loan: Expert Guidance and Solutions

Blog Article

Checking Out the Advantages of a Financial Debt Combination Car Loan: A Comprehensive Overview for Handling Multiple Debts

A debt combination loan supplies a strategic solution by incorporating different obligations right into a single, convenient settlement. What variables should one take into consideration when assessing the suitability of a financial debt combination car loan?

Recognizing Financial Debt Combination Lendings

Recognizing financial obligation combination car loans includes identifying their essential function: to simplify several financial obligations right into a solitary, workable payment. consolidation loan singapore. This monetary instrument is created to aid individuals who are overwhelmed by different financial obligations-- such as bank card balances, individual loans, and medical bills-- by settling them into one car loan with a set rates of interest and term

Typically, a consumer obtains a new funding to pay off existing financial debts, thereby streamlining their monetary landscape. This process not just decreases the number of regular monthly settlements yet can likewise give a clearer course to monetary stability. In a lot of cases, customers may find that the brand-new lending provides a reduced rates of interest than their previous financial debts, which can lead to significant savings gradually.

Trick Advantages of Financial Obligation Combination

One of the main benefits of debt loan consolidation is the potential for minimized rate of interest prices, which can cause significant savings with time. By consolidating multiple high-interest financial debts right into a single finance with a reduced interest price, borrowers can decrease the general cost of their financial debt and boost their monetary circumstance. This streamlined technique not just streamlines month-to-month payments but also minimizes the threat of missed out on settlements, which can negatively influence credit history.

An additional key advantage is boosted cash circulation. With a solitary month-to-month settlement, consumers can much better manage their financial resources, allowing them to allot funds toward various other essential expenses or cost savings. Additionally, financial debt combination can supply a structured settlement plan that assists people repay their financial obligation a lot more successfully.

Moreover, financial obligation combination can relieve the tension related to taking care of several financial institutions, as it consolidates interaction and repayment processes right into one manageable entity. consolidation loan singapore. This can foster a sense of control and help with better economic planning. Inevitably, financial debt loan consolidation supplies a pathway towards accomplishing monetary security, making it an attractive option for those looking for to restore their ground in the face of overwhelming financial debt

How to Receive a Finance

Qualifying for a financial obligation consolidation car loan involves conference certain criteria established by lending institutions to ensure customers can pay off the borrowed amount. The initial crucial aspect is credit report; most loan providers choose a score of a minimum of 650, as this indicates a trusted repayment history. Additionally, a reduced debt-to-income ratio is vital; preferably, your monthly debt settlements need to not surpass 36% of your gross regular monthly earnings.

Lenders also analyze your work history. A secure task with a regular income demonstrates your ability to handle ongoing settlements. Furthermore, offering documents, such as pay stubs, tax returns, and financial institution statements, is typically needed to confirm income and expenses.

Comparing Financial Obligation Debt Consolidation Options

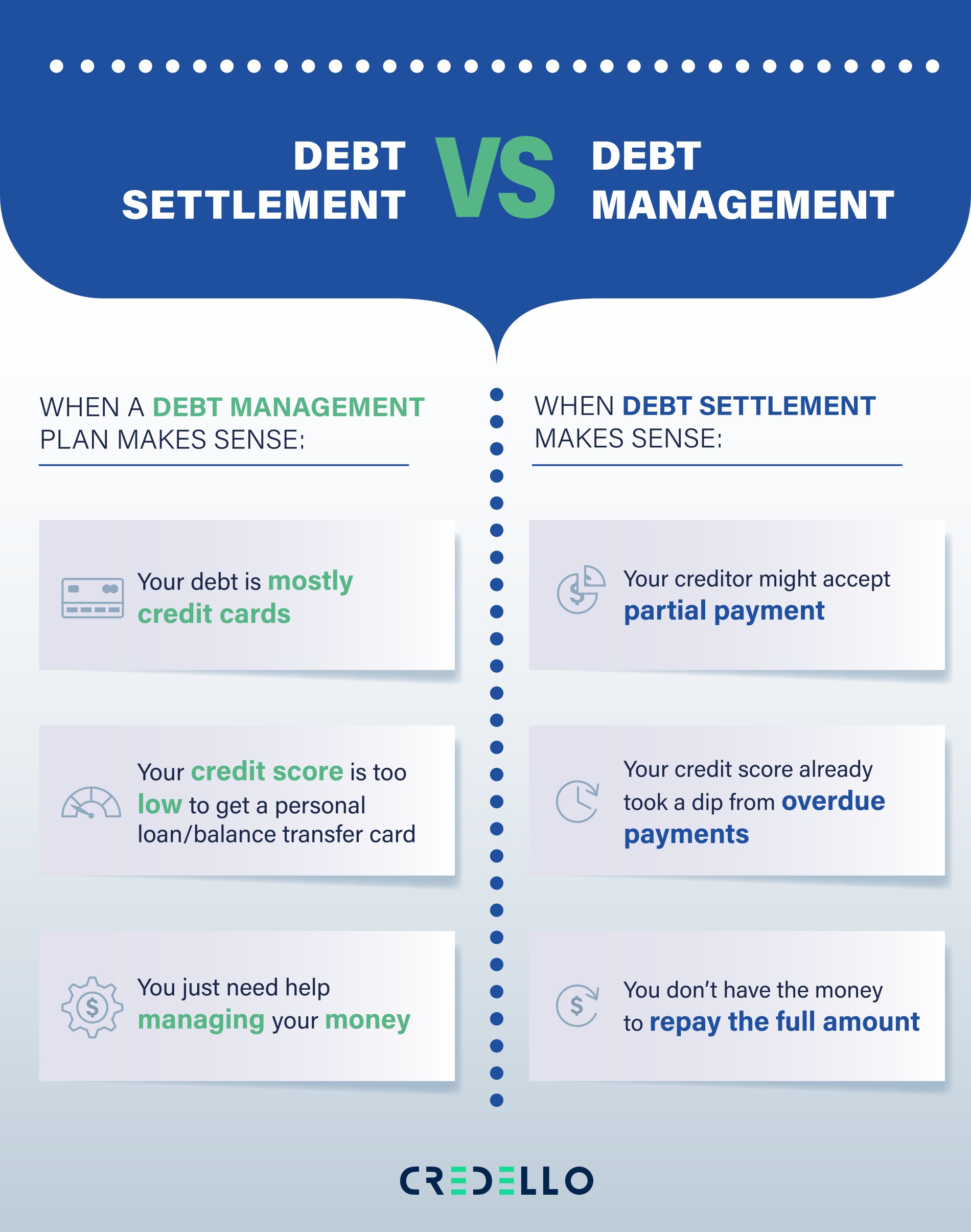

After establishing the requirements for receiving a debt consolidation you can try this out funding, it ends up being important to assess the different options available. Debt combination can take several kinds, each with distinctive functions, benefits, and disadvantages. The primary options include personal finances, equilibrium transfer bank card, home equity car loans, and financial debt management plans.

Personal car loans are typically unsafe and can offer set interest rates, making them a straightforward choice for consolidating financial obligations. Equilibrium transfer credit score cards enable you to transfer existing credit rating card equilibriums to a brand-new card, typically with a reduced or no introductory passion rate.

Home equity lendings use your residential or commercial property as collateral, usually providing reduced rate of interest. Nonetheless, this option lugs dangers, such as prospective repossession. Last but not least, financial obligation monitoring prepares include functioning with a credit report counseling company to work out lower rate of interest prices with financial institutions and create a structured settlement strategy, though they might need costs.

Meticulously considering these options versus your economic scenario will certainly help in picking one of the most advantageous path for financial debt combination.

Tips for Successful Financial Obligation Administration

Following, prioritize your financial debts. Concentrate on settling high-interest financial obligations initially while maintaining minimal payments on others. This method, often described as the avalanche technique, can conserve you cash over time. Additionally, think about the snowball technique, which stresses settling the tiniest financial obligations first to construct energy.

Establishing a reserve is additionally critical. Having cost savings to cover unforeseen costs avoids you from resource accruing additional financial debt when emergency situations emerge. Furthermore, regularly assessing your financial circumstance can help you stay on track and adjust your strategies as needed.

Finally, interact with your financial institutions. Some may supply aid or different settlement plans if you are battling to satisfy settlements. By adopting these methods, you can effectively manage your financial obligations and pursue attaining an extra protected economic future.

Conclusion

In conclusion, debt consolidation financings use a tactical option for people looking for to take care of numerous financial debts properly. By consolidating different economic responsibilities into a solitary finance, borrowers can possibly take advantage of lower rate of interest and simplified monthly settlements. official website This approach not just minimizes the stress related to managing multiple creditors however additionally enhances total financial control. A well-implemented financial debt loan consolidation strategy inevitably functions as a path toward achieving monetary security and advancing toward a debt-free future.

Debt debt consolidation lendings can be secured or unsecured, with protected finances requiring collateral, such as a home or automobile, while unsafe loans do not (consolidation loan singapore). By combining numerous high-interest debts into a solitary financing with a reduced interest price, debtors can decrease the general expense of their financial debt and boost their monetary situation. Additionally, financial obligation loan consolidation can give an organized payment plan that aids people pay off their debt a lot more effectively

Inevitably, financial debt loan consolidation supplies a path toward attaining monetary stability, making it an appealing option for those looking for to regain their ground in the face of frustrating financial debt.

In conclusion, financial debt consolidation car loans use a critical service for people seeking to handle numerous debts effectively.

Report this page